When Can I File My Taxes If I Have Dependents – Arizonans can begin filing their taxes on Jan. 29. Here’s what you should know about gross income and requirements before Tax Day on April 15. . By law, the IRS must wait until mid-February to issue refunds to taxpayers who claimed the earned income tax credit or additional child tax credit. According to the agency, those payments should be .

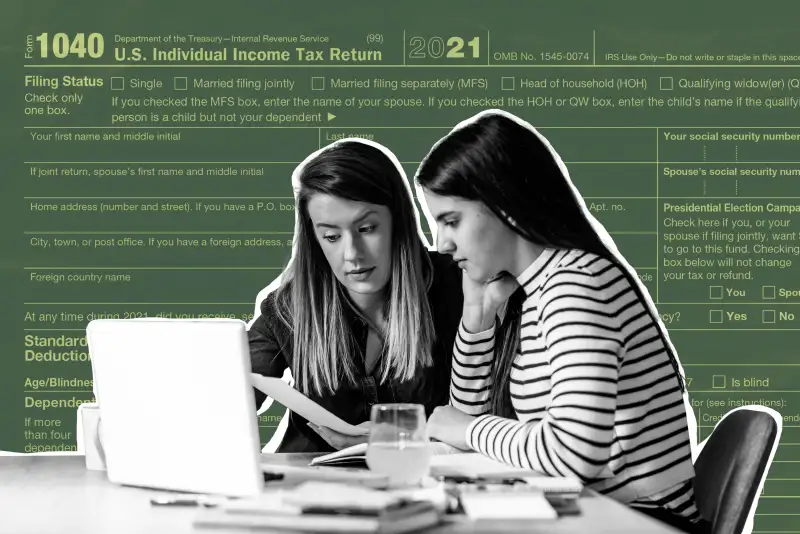

When Can I File My Taxes If I Have Dependents

Source : turbotax.intuit.com

Determining Household Size for Medicaid and the Children’s Health

Source : www.healthreformbeyondthebasics.org

Rules for Claiming a Dependent on Your Tax Return TurboTax Tax

Source : turbotax.intuit.com

Rules for Claiming a Parent as a Dependent TaxSlayer®

Source : www.taxslayer.com

When Someone Else Claims Your Child As a Dependent

Source : www.thebalancemoney.com

Penalties for Claiming False Deductions | Community Tax

Source : www.communitytax.com

Can You File as Head of Household for Your Taxes?

Source : www.thebalancemoney.com

Why Teenagers Should File a Tax Return | Money

Source : money.com

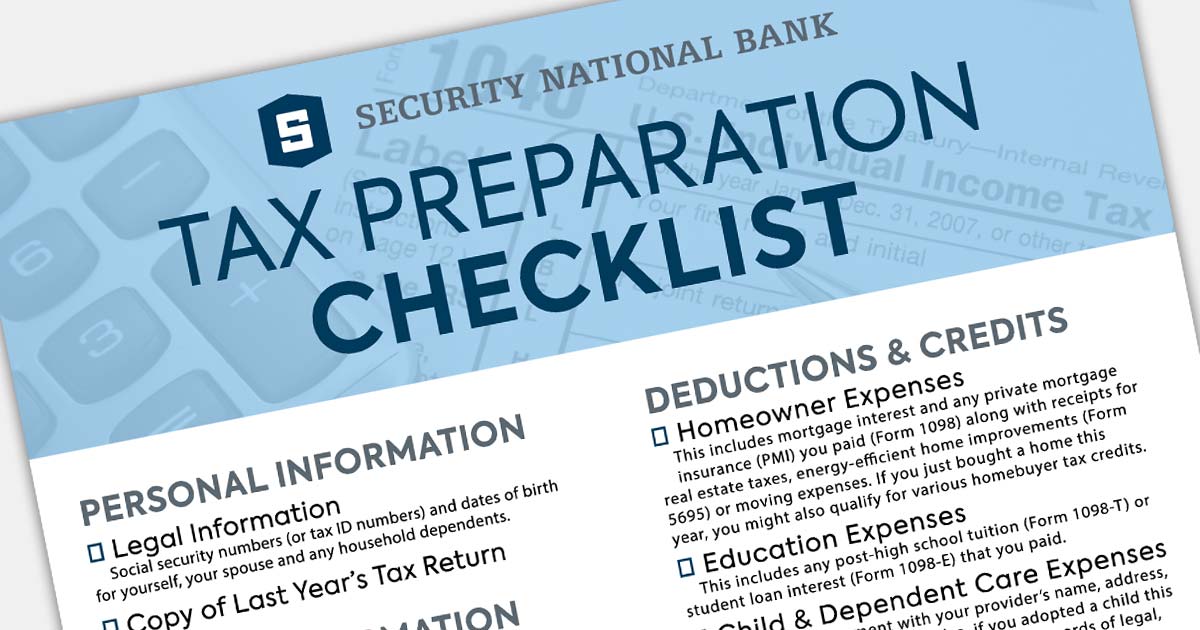

A Checklist: What Documents You Need to Prepare Your Taxes

Source : www.snbsd.com

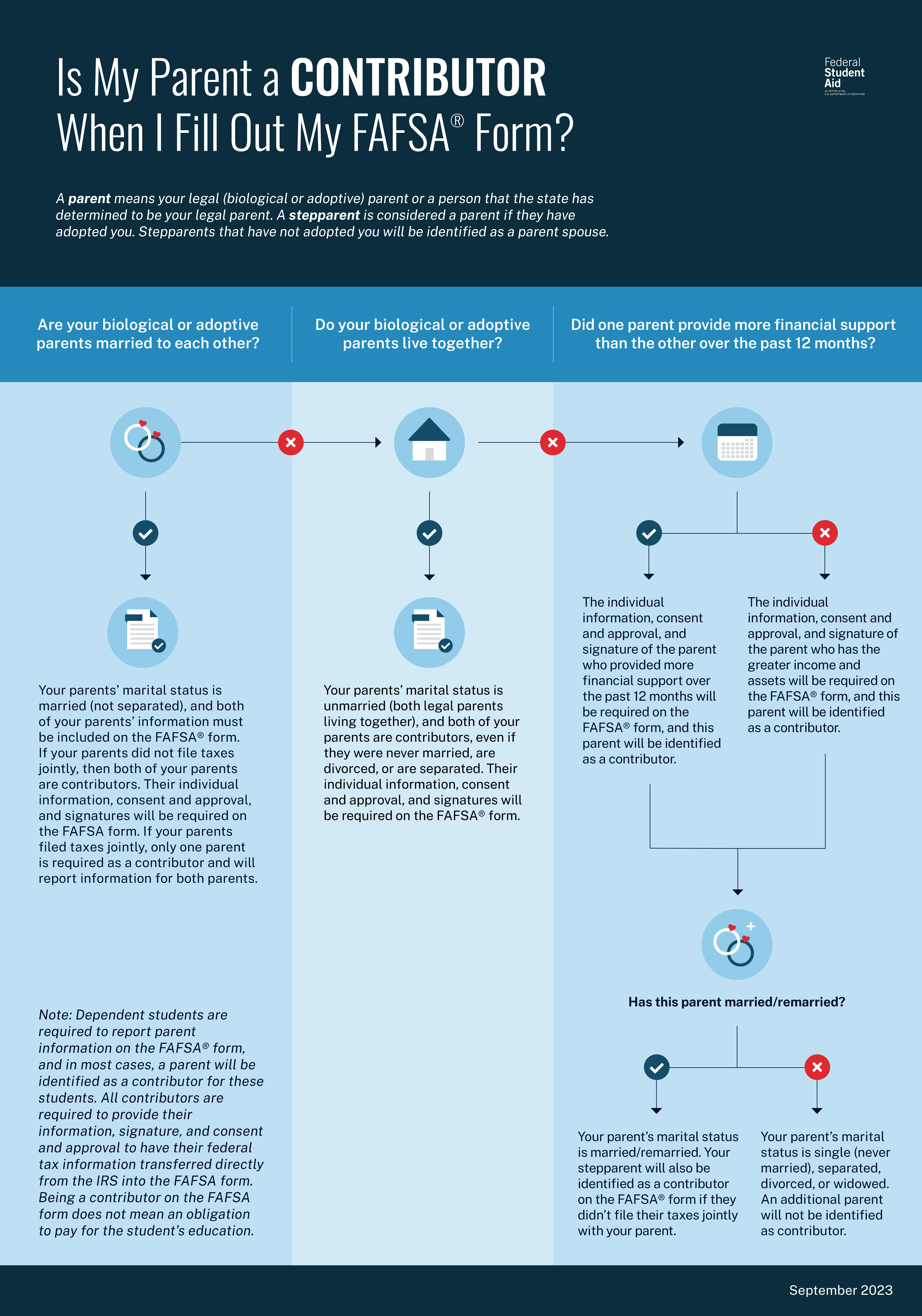

Reporting Parent Information | Federal Student Aid

Source : studentaid.gov

When Can I File My Taxes If I Have Dependents Should I Include a Dependent's Income on My Tax Return : The Internal Revenue Service will start accepting returns married spouses filing separately and qualifying surviving spouses. In addition to the requirements above, some dependents, children . Paper returns can take four weeks or more to process. Taxpayers affected by the severe storms and tornadoes that began Dec. 9 have until June 17 to file various federal and business tax returns .

:max_bytes(150000):strip_icc()/what-if-someone-else-claimed-your-child-as-a-dependent-14afba0c76f846a1a86345d929b455e8.jpg)

:max_bytes(150000):strip_icc()/headofhousehold-b7e9af51251b46a7a108a878b7cf2da3.png)